Fintech:

Facilitating Highly Complex Financial Transactions

Welcome To The FinTech Cloud

Digital transformation is happening at an incredible pace. This makes it difficult for businesses to keep up with new financial and payment technologies while also managing rapidly changing consumer behavior — and efficiently manage complex, high-volume transactions.

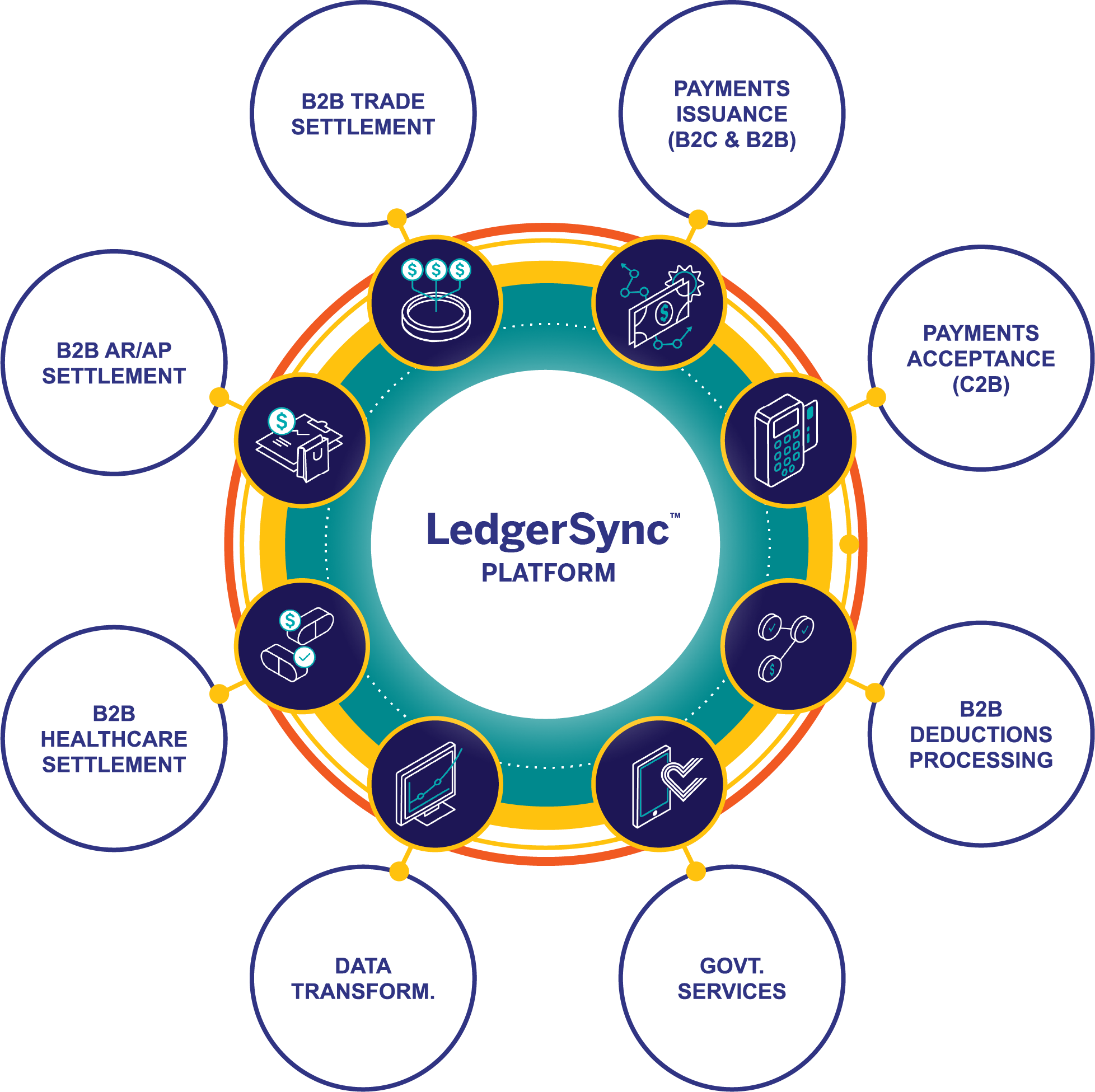

The Inmar Intelligence FinTech Cloud ensures that our partners are positioned to capitalize on this digital transformation. Supported by our data platform, LedgerSyncTM, the FinTech Cloud provides omnichannel payment and settlement solutions to drive top line growth and protect margins. We facilitate highly complex financial transactions totalling over $4.5 billion annually in a secure and efficient manner to enable intelligent and frictionless omnichannel commerce for retailers, manufacturers, financial institutions, healthcare companies, and government entities.

View the FinTech

cloud video

PLAY

PLAY

Fraud Mitigation: we are committed to ending coupon fraud in the industry by 2024

VIEW THE CNFRM VIDEO

PLAY

PLAY

CNFRMTM -- our multi-functional, POS-integrated technology -- prevents counterfeit coupon redemption in real-time at the register. Leveraging a cloud-based decision engine, CNFRMTM immediately validates every coupon scan against positive and negative offer files, identifying invalid and counterfeit coupons before they can be redeemed.

InmarPay Payment Gateway: turning payment strategies into consumer engagement strategies

View the InmarPay video

PLAY

PLAY

InmarPayTM embeds Inmar as a mission critical payment partner with retailers, pharmacies and CPGs, enabling secure, contactless, and omnichannel payments acceptance, with a unique opportunity to leverage tokenization technology to identify and target "unknown" shoppers by connecting payments data with shopper behavior, media and incentives through Inmar's Retail Cloud integration.

Holistic Settlement: end-to-end collaboration platform between manufacturers and retailers

Deductions represent 1-2% in annual revenue leakage for retailers and brands, and over 10% of sales capacity is focused on resolving deductions, with no visibility into root causes. Inmar is driving new visibility with a AI- and SaaS based Holistic Settlement solution. Our real-time, end-to-end collaboration platform will support all B2B payment-related workflows between CPGs and retailers, and digitally transform today's highly inefficient and complex process.

Using Artificial Intelligence/Machine Learning, robotics, and advanced analytics technologies, we are automating both deductions management and trade promotions settlement in order to increase invalid deduction recovery rates and eliminate the need to deduct trade spend.

Relevant Case Studies

Delivering Continuous Financial Innovation

Under The Hood Of The FinTech Cloud

Financial processing capabilities for complex use cases supporting commerce

Cloud-Based Transaction Enablement

Broad payment acceptance, active fraud detection, and real-time transaction validation services all delivered through the cloud

Advanced analytics applied to transactional data

Financial processing data is transformed into actionable insights through artificial intelligence and integrated business intelligence tools

Security + Reliability

Compliant and scalable technology trusted by leading corporations and government entities to securely and reliably process billions of dollars of payments every year

Meet the FinTech Leadership Team

We have invested in leadership. Technology with the right humans to use the tools, ask the right questions and make the right connections is a must to drive digital transformation.